Содержание страницы

eToro was founded way back in 2007 when forex trading had been available online for almost a decade. The company’s founders saw that the only way to differentiate their product from numerous other Forex brokers was to innovate. This led to the combination of Forex trading with social media to create a unique blend of trading and community. We suspect that the timing to incorporate social media was also great due to the growing popularity of a little known website called Facebook (Facebook opened its doors to the public in 2006). We’ve seen the popularity and interest in social trading grow immensely since 2007, with some brokers now offering social trading platforms alongside their standard platform. For those in the know however, eToro remain the pioneer of the term and the home of, Social Trading.

eToro proudly state “We’re more than just the world’s largest investment network: we’re your investment network”. This motto has clearly worked. Since their conception, eToro’s popularity has grown exponentially. They now boast a customer base currently exceeding 4.5 million traders from over 140 countries, and this is growing. The company has also matured from a small team of eager employees to a highly capable international team located at offices in Israel, the UK, Cyprus and Australia. eToro continues to innovate.

Regulatory Information

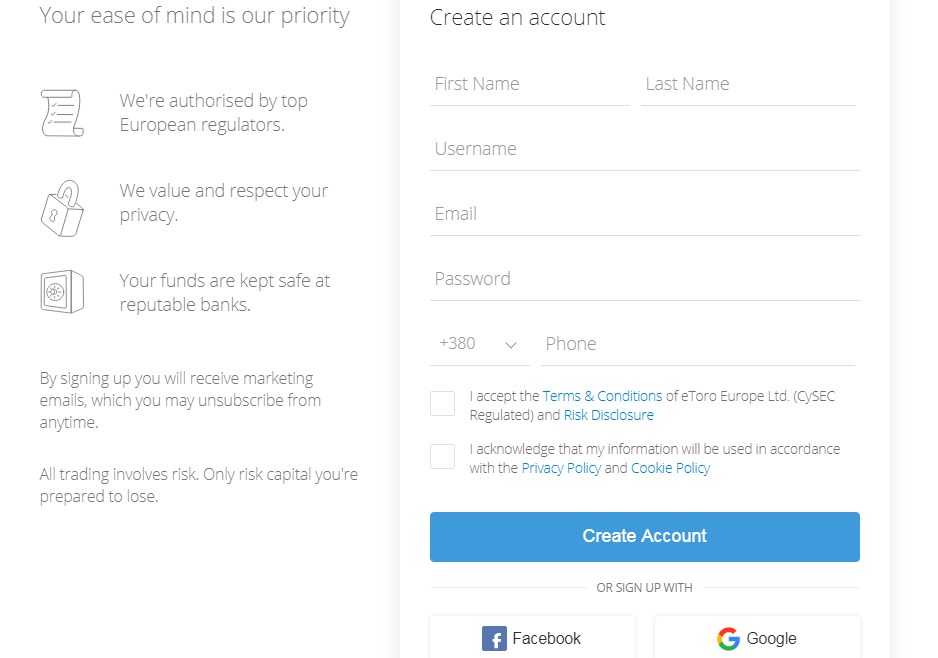

eToro accepts traders from many regions around the world, making this a truly international broker. They are currently authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority – FCA (UK). eToro also operates under the Markets in Financial Instruments Directive (MiFID), and offers cross border services to all member states of the European Union.

At the time of writing (10th October 2016), the only exceptions are Iran, North Korea, Myanmar, Syria, Cuba, Sudan, USA, Japan and Turkey. Canadian traders are welcomed, however, those from Quebec are not permitted to trade at eToro – as per the terms set out by AMF (Autorité des marchés financiers). Traders from ALL other regions are encouraged to trade with eToro.

Social Trading, Trading Platforms and Features

“Social Trading” describes a feature that allows you to view the performance of other traders on eToro, and copy their successful trades. You can search for successful investors according to a wide range of criteria, view their performance statistics, add traders to your “Watch List” to receive the latest updates on their activity. Then copy successful traders with just one click of a button. Once you’ve copied a trader, your account will automatically mirror any trade they make. We noticed that you can copy as many traders as you want and manage your copies like you would manage a fantasy football team – keep the winners, and cut the ones that underperform.

TradersAsset Tip: Always manage your risk by setting Stop Loss orders on your copies just like you would on regular trades.

This transparency on successful traders and strategies is unique in the world of Forex. The feature will appeal to traders with little/no experience, helping them trade and profit using the tactics of proven performers. More experienced traders looking to diversify and increase the volume of their trades can also benefit here. Another item worth noting is that eToro’s social trading model rewards more experienced traders that have their successful trades copied. The broker elevates these traders to “Popular Investor” status and allows you to earns additional cash rewards. This truly encourages a fantastic community scenario, thereby giving more credibility to eToro’s “Social” element.

Trading Platforms

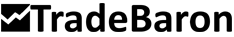

eToro provide its customer with two platforms to invest in Forex and CFD’s; the eToro Web App and the eToro Mobile Trader. These platforms provide traders with complete access to the eToro network whether you’re trading at home or on the go. As you’d expect from a pioneer in social trading, both platforms offered are proprietary technology and therefore exclusive to eToro. We found both interfaces to be slick and intuitive. All functionality is also presented in the familiar social media format. A nice social feature is that eToro encourages traders to interact through discussion walls, personal messages and various feeds. It’s worth noting that both Web and the Mobile platforms offer all-in-one portfolio management solutions that have a number of options, including those that allow you to trade and manage your manual and copy portfolios.

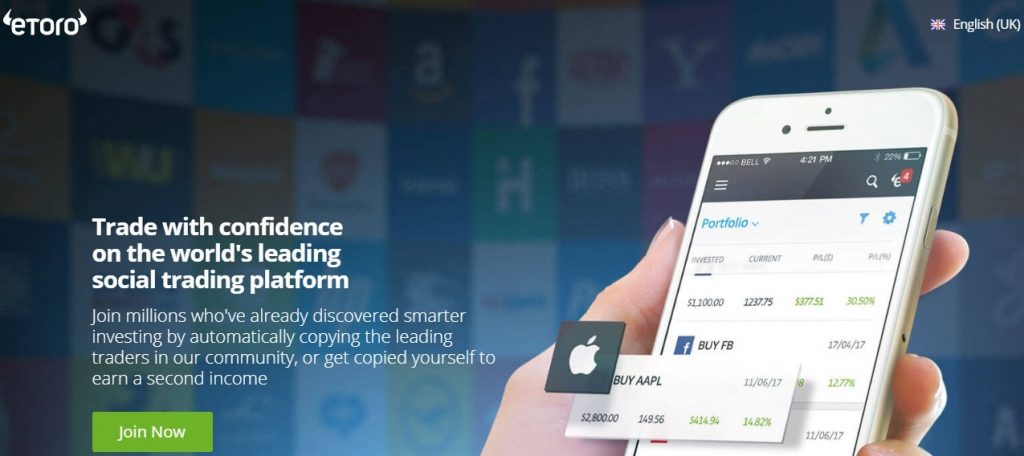

- eToro’s Web platform uses a sleek and simple interface to display live rates, comprehensive charts, open positions and orders. It provides easy access to a diverse array of financial markets, including Forex, Commodities, Indices, Stocks, ETF’s and even Bitcoin. It allows traders to easily edit Stop Losses and Take Profit orders, or manage their Copy Trading activity and is compatible with both Mac and PC based devices.

- eToro Mobile Trader– eToro provides free trading apps compatible with Android and IOS mobile devices. These can be found at Google Play or in the Apple App store respectively. The apps are a fully functional, scaled-down version of the eToro platform. App users can also view the latest discussions, news and market pages. Traders can also manage their portfolios by accessing live rates, charts and viewing open and closed positions (copy and manual), edit stops and much more.

Support Services

As with most brokers of this pedigree, customer support is a priority. The eToro support team can be reached via telephone, chat, email and offer various methods of on-platform online support. We highly recommend that you check out the extensive FAQ section and chat function for any straightforward queries. eToro present a huge amount of highly useful information in there and most concerns can be dealt with in minutes. If the FAQ section doesn’t help, the telephone support team are available to assist you 24hrs a day, on weekdays.

You will have to sign up to access the online support services. Once you are a registered client, the Livechat support services are available 24hrs a day from Monday to Friday. This is an incredible resource for new traders. Online support such as the “Customer Service Wall” is available 24hrs a day, 7 days a week and provides clients with prompt responses. Email support is offered via their online form and is available to both registered and unregistered customers. Simply fill out the online form and the support team will reply within 48 business hours.

We actually tested the various support methods, even at weekends when trading was closed, and still received prompt responses. In our opinion, eToro’s support are clearly a knowledgeable team that are keen to help their clients.

Banking Options

The eToro platform only allows trading in US Dollars because a unified currency is required to provide transparency to their global network. You may deposit from multiple currencies, but your deposit will be converted into USD before trading.

The minimum deposit amount varies, but the UK, EU, Aus and Canadian minimum is $200 for Credit and Debit Cards, Paypal, Neteller, 1-Pay, Skrill, Webmoney and GiroPay. The minimum deposit for Wire Transfer is $500. eToro offers Islamic accounts for a deposit of $1000. Please note that most electronic payment methods, including the hugely popular Paypal, will allow traders to credit their account and trade within minutes but Wire Transfers can take up to seven working days.

As always, we recommend you verify your account on sign up to avoid delays on withdrawals. Once your account is funded and verified, simply trade as normal. When you’re ready to make withdrawals, the process couldn’t be easier: Click on the “Withdrawal” tab on the platform, enter the amount to withdraw (in USD), and click “Submit”. This will complete the electronic withdrawal procedure and notify you via email once processed. Traders are subject to withdrawal fees. eToro will charge a maximum fee of $25 (for withdrawals over $500), and your withdrawal will be completed within five business days.

Why Trade Forex and CFD’s at eToro?

Are you new to trading and looking for an unintimidating way to learn and profit soon? Alternatively, are you an experienced trader looking for a more interaction, more recognition and higher rewards of your trading skills? If the answer to either is “Yes”, this is where eToro comes in.

New traders should think of eToro as an access point to the world of online financial trading. The demo account feature, low deposit amount, social network of expert traders and the “CopyTrader” function alone make your entry into the lucrative world of financial trading as smooth as possible. If you are a more experienced trader, why not get recognition AND get paid for your experience and skill? Create an account, build a social following and encourage novice traders to copy you. Once you are a Popular Investor and have a number of qualified copiers, you can start earning monthly rewards. Please read the FAQ section on the eToro website for more information on the perks of being an experienced trader.

eToro was the first global marketplace for people to combine trading and social media. No matter what type of account you open at eToro you will always get access to industry leading customer support, rapid payouts and of course, their award winning platform. It’s our pleasure to confirm that eToro have met with our strict criteria and have earned their status as an “Approved TradersAsset Broker”. We encourage you to try them out for yourself.

Please note:

* All trading involves risk. Only risk capital you’re prepared to lose.

* Past performance does not guarantee future results.

* Trading history presented is less than 5 years and may not suffice as basis for investment decision.”