Содержание страницы

- 1 Tastyworks – Reviews & Ratings

- 2 Overview and Summary

- 3 Is Tastyworks For You?

- 4 Technology

- 5 Trading Platforms

- 6 Mobile App

- 7 Tools and Resources

- 8 Account Types

- 9 Customer Service

- 10 What You Can Trade At Tastyworks

- 11 Pricing

- 12 Special Pricing Model

- 13 Stocks Trades

- 14 Stock Options

- 15 Other Fees

- 16 Education

- 17 News & Research

- 18 Great Technology

- 19 Mobile Apps

- 20 Pricing and the $0 Commissions

- 21 Where Tastyworks is Lacking

- 22 Something You Should Know

- 23 Bottom Line

Great new software and the ability to watch expert traders in real-time as they work might be the perfect solution for many investors.

Tastyworks – Reviews & Ratings

Tastyworks is trying to make life easier for active traders. Be it through handy technology, low pricing, or good customer service, Tastyworks seeks to solve the common problems that are bugging investors worldwide. Tastyworsk was founded in 2015 and launched to the public in 2017 by a group of highly experienced and reputable experts in the field of investing.

Overview and Summary

- Powerful, one of a kind technology with a simple, customizable UI.

- Good analytical package with a tool for calculating the probability of profit, among other things.

- The only available investment types are futures, stocks, and options.

- Unique pricing model with $0 sell commissions.

- No inactivity fees or minimum balance requirements.

- Interesting education offers including the option to watch pro traders as they work in real-time and copy their investments just by clicking.

Is Tastyworks For You?

Tastyworks caters to experienced stock, options and futures traders, or those who are looking to become more skilled. If you’re new to the whole investing thing, this platform will allow you to watch pros at work in real-time, which can be a great learning experience.

Although, if you want to deal with something other than the aforementioned investment types, this platform is not for you. Also, day traders might like the user experience and the nonexistent sell commissions.

Technology

Tastyworks offers a number of platforms, each with its own unique properties. The technology Tastyworks’ team developed is generally well-received. Let’s take a quick look at their offer.

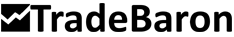

Trading Platforms

Tastyworks offers multiple desktop platforms. They can work either through a web browser or through a downloadable app, though the latter is a bit faster. They are nearly identical in all respects and the UI should feel very natural to experienced traders. The web version can run in the majority of popular browsers. The desktop version is optimized for Windows, Mac, and Linux, so all fields are covered in that respect. In all cases, the platform is a very stable and safe piece of software.

Mobile App

The mobile app is available for iPhone 6 or newer and all modern Android phones. The mobile version of the app runs on Android and iOS devices and is made to minimize the amount of data entry you have to do by using drag and drop controls.

The majority of features you would get from the web or desktop platforms are also available on the mobile system. Tastytrade video feed – one of the most noteworthy features of this platform – can also be accessed from your mobile device. Since you can not open an account through the mobile apps, you must use the web or desktop version.

Tools and Resources

You can easily create portfolios and watchlists, and observe the company’s pro investors in real-time while they trade with the platform. This platform allows clients simultaneous access to multiple accounts, which is a great feature for traders who are used to a certain level of complexity. These platforms also give users the ability to monitor Tastytrade Live without leaving Tastyworks.

Over 90% of the trades placed by Tastyworks’ users are derivatives, therefore, futures traders have an abundance of options and tools to choose from. The analytical package you get can calculate the probability of profit, which is helpful when you are planning your trades. You can use the built-in spreads, or create your own. If you have a position in a specific strike, it will pop up on the graph.

Getting graphs, reports and other useful info you need to make intelligent trade decisions is fairly easy too, as the system is well designed. If you want a deeper analysis of your portfolio risk, you can go to Quiet Foundation and create an account. This is a registered investment advisory operated by Tastytrade and Tastyworks. You can connect all your brokerage accounts if you want to look at them together, and users do not pay fees for the investment assessment.

Account Types

There are different types of accounts you can choose from. The prime one is an individual margin account called “The Works.” This account gives users access to options and stock trades.

Users can make stock and futures trades with this account, as well as option spreads and covered and uncovered trades for options.

Customer Service

As far as customer service is concerned, it can be reached by phone, live chat, or email. There are also special email addresses that are available for different kinds of problems.

You can find some useful info by looking at the help that is built into the platform but there is no chatbot capability. However, customer service is usually very quick to respond to queries, so there is nothing to worry about in that respect.

What You Can Trade At Tastyworks

Tastyworks is optimized for stock, futures and options trades, so if you want to look at other investment types, you will find Tastyworks lacking. Up until recently, Tastyworks was only for stocks and options, but this year they started working with futures too.

As the selection of investment types is limited, Tastyworks may not be the right place for bond and mutual funds traders. Although, the limited number of investment types will not deter most active traders, especially the ones who like Tastyworks’ live video service. Also, Tastytrade is currently one of the best platforms for trading options. Keep that in mind if you are an investor interested in trading options.

Pricing

No online broker is truly great for investors without a great pricing system. Tastyworks offers low commissions for most investment types and doesn’t burden traders with account minimums and inactivity fees.

Special Pricing Model

Tastyworks’ pricing model is unique in the brokerage industry, and it’s hard to find anything similar. The second trade doesn’t incur closing fees whether you are dealing with options on futures or options on stocks.

This means are charged a commission fee when you buy/open, but not when you sell/close. Also, the minimum balance is $0, which is something that new investors might find relieving. There are also no inactivity fees.

Stocks Trades

All stocks trades have a $0.0008 clearing fee, and they have a $5 commission (and no commission fee when selling). Although a $5 commission is slightly more expensive compared to many other brokers, you can save a bundle because of the $0 closing fees. For some traders, this can cut costs by roughly 50%.

Stock Options

Stock options incur a $1 commission when you open, but the commission is zero when you close. The clearing fee is $0.1 per contract for all trades, and the highest equity commissions you can come across are $10.

Other Fees

Futures have a $1.25 opening and closing fee. All futures trades have a $0.3 clearing fee per contract in addition to the exchange fee. The highest margin accounts’ rate is 8% for accounts with less than $25.000, and if you have $1.000.000 or more on your account, the rate is 5%.

There are also other potential trading and bank-related fees you might incur, but these are not as important. Anyway, this pricing system gives good opportunities to many stocks, options, and futures traders.

Education

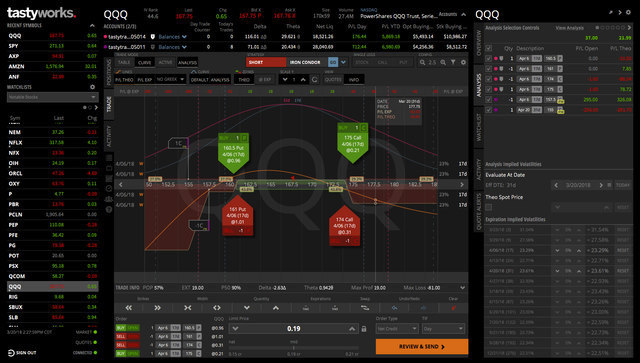

Tastytrade gives you the opportunity to follow actual active traders and experts as they work. You can watch a live video every trading day, and if you still want more, then you can take a look at the video archive for more content. They also have entertaining free live events that are held all across the U.S.

The Tastyworks team has recently launched Luckbox Magazine, their new digital publication. Proactive investors who want to make more lucrative investment choices based on probability models may find the magazine interesting and useful.

For new investors who are looking for a good platform to start trading, Tastyworks might be the right choice. In this regard, Tastyworks can compete with the industry’s finest. There is no deposit fee and the minimum balance is $0. That along with the intuitive software and the great live feed gives Tastyworks the edge when it comes to user experience for beginner investors.

News & Research

One handy feature is being able to access a live feed where you can find out what their team thinks is happening in real-time.

Tastyworks’ professional traders publish their trades and results, so you can pick your favorite one and follow them in order to get valuable info from a proven trader in an instant.

This can be done through a super simple menu, that show the traders and their trading stats. You can copy their trades just by clicking on them as they pop up on your screen.

Great Technology

The technology isn’t only safe and stable, but fast too. The pricing system is very good as it allows traders to intuitively make low-cost trades. The interface is also very smartly designed as it is easy to maneuver, and the scanners allow you to mark securities which are increasing in volatility. The ability to use the platform directly from the browser, without downloading is something that many other brokerages do not provide. Tastyworks software is easy to use and the dashboard is customizable to meet all kinds of preferences. This gives all traders a great UI to work with without hassle.

Mobile Apps

The mobile apps are fully functional and give you roughly the same resources as the desktop or web versions. The orderliness of the UI is great for users who like to keep their data visually organized. Liquidity, probability of profit, and volatility for their charting tools are the main focus of the platform.

Pricing and the $0 Commissions

Day traders who deal with stocks, futures, and options will find this platform full of awesome perks. The unique pricing system allows investors to sell and close for $0, which can cut costs greatly, even though the trading fees for buying and opening are higher than average. An additional perk is the $0 minimum balance and no inactivity fees, which new investors might find very appealing.

Where Tastyworks is Lacking

The number one limitation that Tastyworks has is the lack of investment types. You can only trade options on stock, options on futures and futures, everything else is off-limits. The platform is optimized for day trading and generally lacks in features if you don’t fall into this category.

Some day traders also find that the fixed commission rates don’t work for them. Although the margin fees can be negotiated down, they are higher than average for very active trades. Also, traders can not stage orders for later entry or place multiple orders at the same time. Therefore, this platform might not be great for day traders who like to place multiple large bulk orders at the same time.

Something You Should Know

Tastyworks is made for active and determined derivatives traders. Along with the content you can get on the Tastytrade Network, this platform is great for advancing skills related to analyzing risks in your trading practice.

Passive mutual fund investors will definitely look elsewhere to satisfy their needs, but if you’re looking to improve your derivatives trading skills, maybe you should take a good long look at Tastyworks.

Bottom Line

Tastyworks offers a discount brokerage that is surely worth taking a look at if you are interested in active stock, options, and futures trades. Tastyworks is a great boon for Tastytrade users who want an integrated trading experience. The average investor might want more investment types, and the low fees don’t make up for Tastyworks’ clear scarcity in that department. Tastyworks does not work for everyone but is a mighty tool for its target audience.

Leave a comment