Содержание страницы

AvaTrade have been at the forefront in the world of Forex since they launched their online trading platform in 2006. The company was a joint effort by eCommerce, security and financial professionals who were determined to provide the perfect online trading experience for retail traders. The broker has grown rapidly since its formation in 2006 and currently have over twenty thousand registered customers. These traders place in excess of two million trades each month and generate a total trading volume that surpass $60 Billion per month.

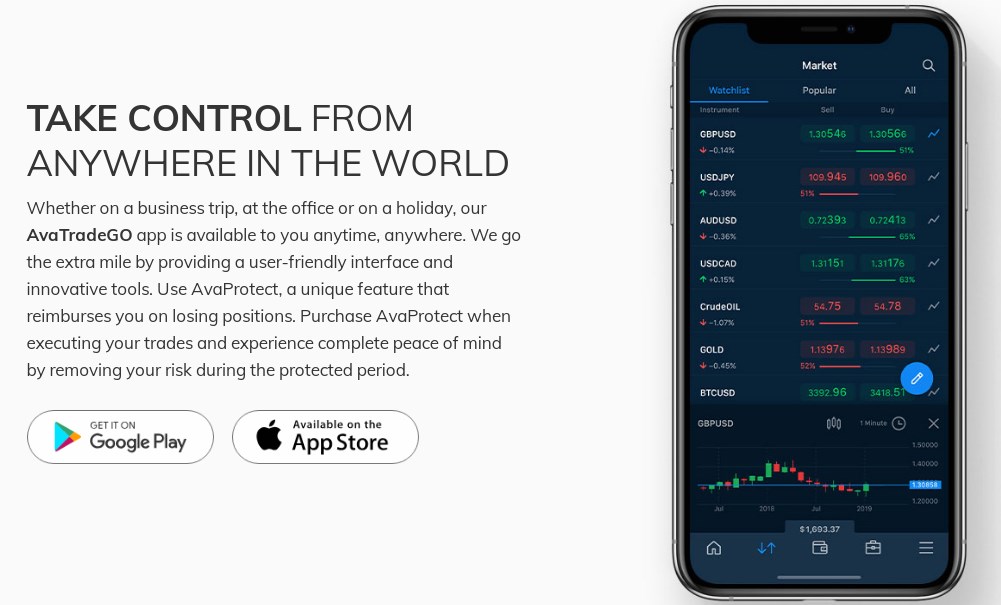

AvaTrade is headquartered in Dublin, but are a truly international operation. They have offices and sales teams located in Paris, Dublin, Milan, Tokyo, Sydney and New York. They offer 24-hour multilingual support services, multiple platforms and a wide range of trading instruments including Forex, Stocks, Commodities and Indices. AvaTrade continues to evolve, improve and offer its customers a fantastic trading experience.

Licensing & Regulation

Unfortunately, US based traders are not be permitted to use the Forex trading platforms at Avatrade. Traders from all other territories are welcome.

Avatrade is subject to stringent compliance requirements from a number of international regulatory bodies, as you’d expect from a broker that accepts traders from multiple territories.

- Europe: AVA Trade EU Ltd are authorised and regulated by the Central Bank of Ireland (CBI). They are also licensed and compliant with the Markets in Financial Instruments Directive (MiFID). These cover all operations in Europe.

- Australia: Ava Capital Markets Australia Pty Ltd is licensed in Australia by the Australian Securities and Investments Commission (ASIC). All Australian traders can trade at AvaTrade without issue.

- Japan: Ava Trade Japan K.K. is licensed and regulated in Japan by the Financial Services Agency (FSA).

- International: Ava Trade Ltd is registered as a financial services company in the British Virgin Islands, and is fully regulated by the British Virgin Islands Financial Services Commission (BVI FSC). This enables them to accept clients from international markets.

- South Africa: Ava Capital Markets Pty is regulated by the South African Financial Services Board (under licence FSB No.445984).

Accounts, Trading Platforms & Features

AvaTrade works hard to appeal to the needs of a global trading community; providing platform options that cater for all traders irrespective experience, location or technical preference. To do this, they have strategically made their platform option list diverse and multi-functional.

- MetaTrader 4 (MT4) – World renowned within the online forex trading community, MT4 continues to hold universal appeal and attract new users with its reputation. The platform was developed to offer versatility; with tools, features and customisable elements that may be formatted to suit the user’s personal style and needs. Both professional and novice traders are cared for with MT4’s programming and layout, which includes multi-chart view, live market analysis, Expert Advisors, auto-trading functions and account management features. The AvaTradeGO mobile application is designed to work with the AvaTrade MT4 account, allowing users to manage multiple MT4 accounts, including demos, real, fixed, and spread based. This is available to Android and Apple based tech users. MT4’s primary platform remains a downloadable program, which must be installed and run from a desktop. AvaTrade has made this possible for PC and Mac software users – simply follow the instructions and links found on their website.

- AvaOptions – AvaTrade’s proprietary platform is marketed as an advanced piece of software that caters for every trader. Customers can rest assured that AvaTrade’s option offerings are devoid of the higher risk products that were prevalent online a year ago. It features a combination of spot and option types, with expiration dates (minimum of one day, a week, to a maximum of one year), 40+ forex pairs, gold and silver, with what the broker refers to as ‘Vanilla’ calls and puts. Traders can also use stop and limit orders based on premiums, which give them greater control on their trade’s entry and exit. Risk management tools are included – analyzing their portfolio simulation, risk, and much more. A demo account is available for trading FX options through this platform. This comes with $100,000 of virtual funds, and assistance from the support team.

- Automated Trading – Acknowledging a third wave of online traders, AvaTrade knows how crucial it for some customers to access social trading programs to assist them with their trade positions and application. DupliTrade is a user-friendly social trading platform that allows traders to automatically duplicate the actions of more experienced traders, directly into their AvaTrade account. Successful traders (that have been ranked according to proven history of positive trading results) make up a portfolio of potential strategy providers, facilitating novice traders in their goal to receive legitimate trading direction and analysis, without any of the fuss or educational background. Auto executions can be adjusted to meet the appropriate risk exposure preferred by users. Similarly, ZuluTrade (which can be connected to an AvaTrader’s MT4 account) allows users to follow and copy seasoned traders, welcoming them into a successful trading community. Both options are available through independent mobile trading apps.

Clients are not expected to simply know which platform is best suited to their trading style and requirements – AvaTrade offers a demo account to all new customers to assist with this decision. Traders should refer to the individual platform option information page before proceeding.

Live accounts include:

- Retail Account – All traders will be eligible for the Retail Account, which comes with Negative Balance Protection, segregated account holdings, a dispute settlement service, risk warnings and standard leverage of 30:1 – which is safely under the recommended 50:1 figure that most regulatory bodies advise for financial risk aversion.

- Professional Account – Professional Accounts are designed for traders who have been sufficiently active in the markets for over 12 months, carrying out transactions of significant size and frequency. Relevant markets include OTC Derivatives, such as leverages CFDs, FX pairs, or spread betting. Alternatively, eligible parties would have a financial instrument portfolio worth $500,000 or more. The Professional Account allows for 400:1 leverage access, but with the training wheels removed. Account holders will no longer have risk warnings or access to the dispute settlement service, which allows direct assistance through the Financial Services and Pensions Ombudsman service. Traders who consider taking on this account should therefore be aware of the potential losses that negatively closed positions may incur.

Islamic accounts are also available upon request. Restrictions apply.

As from November 2018, AvaTrade’s asset categories list includes a range of seven cryptocurrencies / alt currency options. These are Bitcoin, Bitcoin Cash, Bitcoin Gold, Ripple, Ethereum, Litecoin and EOS. Traders are able to trade these with up to 2:1 leverage on Retail Accounts and 20:1 on Professional Accounts (these are a high-volatility investment), on the MT4 platform only.

IMPORTANT NOTE: When signing up for an account with AvaTrade, new clients will be asked to volunteer information regarding their financial status, knowledge of trading, and other personal data. The broker will determine your eligibility for a live trading account based on this information. If opening an account is not in a client’s best interests, AvaTrade will attempt to dissuade them from continuing on the grounds of risk exposure, redirecting them to a demo account and disclaimer. Customers may choose to continue with the setup process if they wish, but TA does not encourage this.

Fees & Commissions

Using the USD/EUR pair as an example, spreads vary according to the account type in question. Retail Account users will find that their spread ranges with a 1.30 pips average, whereas Professional Account holders will benefit from a tighter average of 0.9 pips. Overnight interest rates apply to open positions across all assets, and fluctuate according to product type and volatility. A list of upcoming CFD Futures Rollovers can be found broken into asset categories on the AvaTrade website.

Commission is included in all spread quotes.

Education Resources & Support

AvaTrade claims that quality customer service is at the heart of their business. They offer guidance with regional contact numbers, an online educational suite and their multilingual live chat facility – which is in operation 24/5. Unfortunately, we didn’t feel that the agents we tested manning this feature were adequately equipped for a customer-facing role; we were greeted with ridged, scripted assistance in tentative English. Although we reached the answers sought eventually, our team felt that for the standard of service offered by AvaTrade (and with their years of experience) we expected a little better from them.

That being said, the Education resources found on the AvaTrade website was a rich library of trading video tutorials, downloadable eBooks, analysis guidelines and more. Trading assistance for beginners is clearly at the forefront of AvaTrade’s mission here, although professional traders may still turn to the books for a refresher course in FX basics. This section also includes a link to the Sharp Trader website where AvaTrade manages the bulk of its resources – including an economic calendar, news analysis, blog entries and advanced strategies. We recommend running a demo account to trial any lessons learnt here.

Bonuses and New Customer Promotions

You may claim $125 to $10,000 in bonus funds at AvaTrade. This is dependent entirely on your initial deposit amount. The bonus funds are credited to your account instantly once your identification has been verified. Please make sure that you have the relevant identification documents at hand when registering your account to ensure a quick and effortless registration.

Banking Options

Once an account has been registered, clients will be directed to their dashboard cashier point where they will be advised to make their opening deposit.

Deposit

To begin live trading, a trader must fund their live account with at least 100 units (in USD, GBP, EUR, or AUD – depending on the base currency of their account). AvaTrade recommends an initial deposit of at least $1,000 if possible, as this is accompanied with direct one-on-one sessions with an account manager. Deposits can be made via wire transfer (bank options limited by region), Visa or Mastercard. Wire transfer deposits will need a minimum of $500. No fees will be charged for this service.

In order to verify your account for security purposes, all customers will be asked to submit a copy of their ID (passport or driving licence). Additional documents may also be required, and will be requested from you directly by an account manager. The verification process will take up to 10 working days to complete. Customers will not be able to withdraw any funds whilst this is pending.

Withdrawals

When cashing out, customers will have the same banking options as with deposits. Up to 200% of the amount of a trader’s initial deposit total will be returned to them through the same payment method used to fund their account. Further amounts can be withdrawn by alternative payment methods.

There are no fees involved in this process, however it may take up to 6 working days for wire and credit card transfers to complete.

Promotions and bonus offers are not advertised but are made available to customers from certain regions according to the broker’s discretion. The terms and conditions of such offers may restrict a trader’s rights to withdrawal.

Why Trade Forex at Avatrade?

Have a look at the extensive trading information on the AvaTrade website. Once you truly understand the flexibility and options on offer at this well-established broker, we recommend that traders devote some time to exploring the resources and information on offer at AvaTrade. Have a look at the Education area. AvaTrade offer extensive video tutorials, eBooks, webinars and many articles dedicated to helping make AvaTrade customers the best traders they can be. Traders of all levels will find everything you need to ensure a successful trading career.

AvaTrade has done their utmost to appeal to every style of trader presently exploring the markets. Their asset list and range of platforms are clearly designed to attract a wide demographic, including fully novice traders who may require inclusive guidance.

$100 is a fair opening deposit amount for live account launch, and is a reflection of the company’s awareness for risk management. Whilst some may feel that it is a little steep, it offers a trader the chance to protect themselves against the volatile products on offer through this broker. Similarly, we were impressed to see a lower average leverage option for standard account holders, who really needn’t be exposed to greater margin in the early stages of their online trading career. Yet experienced traders are not forgotten, and a carefully crafted Professional Account is available with a default leverage of 400:1 with added benefits.

Whilst AvaTrade lets itself down customer service, we’ve seen worse. We would like to see them make some improvements in this area.

Leave a comment